VA loans in Orlando are common in that they are guaranteed to eligible vets by VA and issued by qualified lenders and banks. These loans are designed to provide home financing for Florida veterans that are eligible or surviving spouses.

VA loans in Orlando are common in that they are guaranteed to eligible vets by VA and issued by qualified lenders and banks. These loans are designed to provide home financing for Florida veterans that are eligible or surviving spouses.

The VA mortgage program’s primary objective is to ensure that eligible veterans have adequate home financing with little out of pocket costs. The fact that the program permits up to 100 percent financing is especially good for vets living in higher costs housing locations around Orlando – Orange, Seminole and Osceola County.

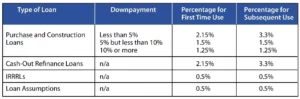

The main benefit of the VA loan is that it allows veterans financing of up to 100% of the home’s value, with no need for mortgage insurance. This allows can save vets hundreds each month when compared to other conventional and FHA loans. The funding fee for the VA loan is 0 percent (for most disabled vets) up to 3.3 percent of the entire loan, payable to the VA and commonly financed in the home buyers loan amount. Please see the 2024 Funding Fee chart below.

The fact that there isn’t any monthly PMI is also a benefit for the veterans, since they qualify directly for the entire loan amount, and may even get larger loans while making a similar payment. The VA also allows for many different streamline refinance options like VA IRRRL or “Interest Rate Reduction Refinance Loan” Homebuyers with equity may also take interest in the VA cash-out refinance program, this program allows cash out refinancing up to 100% loan to value.

Note: Eligible Veterans and Active Duty looking to purchase a high-cost home can learn about the special VA Jumbo Loan here.

Qualifying for Veteran Home Loans in Orlando:

The Veteran Loan program is made specifically for veterans who have met the average number of days in their service. Other forms of eligibility for the VA loan program may include the service commitment, character of service, duty status, and the length of the service. Like all home loans, VA does have minimum standards required to get approved:

- Most mortgage companies will require a 580 credit score for Vets that finance up to 100% loan to value. This credit score requirement does not automatically guarantee loan acceptance or pre-approval. Lenders do have additional requirements for any vet with a serious past financial hardship like past foreclosure or bankruptcy.

- Veterans will need to document income – whether by a job or disability.

- Single-family homes, approved condominiums or town homes in decent good repair – that meet min HUD standards.

MORE: The Veterans Administration provides some good info on How To Apply For Your Certificate of Eligibility.

Advantage of VA Home Financing:

- 100% financing with no mortgage insurance costs.

- Seller can pay home buyers closing costs.

- VA loans have some of the lowest interest rates available today.

- Secure 30-year fix, or 15-year terms.

- Vets can apply and get pre-approved all within minutes.

- Assorted refinance options are available.

Contact us today to learn more – just call Ph: 800-743-7556 or submit the Info Request Form on this page for quick service.